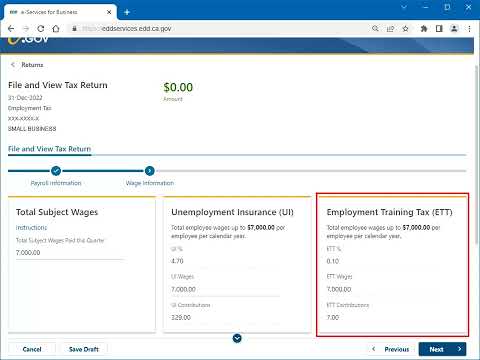

The California Employment Development Department (EDD) developed this tutorial to assist you with navigating through e-Services for Business. Here is a list of tax returns and wage reports you can file using e-Services for Business. This tutorial will show you how to file a Quarterly Contribution Return and Report of Wages (DE 9) and a Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) for an employment tax account and can be used as a guide when filing other tax returns and wage reports in e-Services for Business. This is the e-Services for Business home page. The filing periods that require your attention are displayed on the home page for your convenience. Select File Return next to the period you wish to file. This page shows you the status of the tax return and wage report for the filing period. To file your tax return for this period, select File Now. Answer the question, “Do you have payroll to report?” by selecting Yes or No. For this example, we will select Yes, then select Next. Select Instructions for assistance, then enter the total subject wages you paid and the total employee wages subject to Unemployment Insurance (UI) contributions. The UI contributions are automatically calculated based on the UI wages you entered. The amount in the Employment Training Tax (ETT) section are automatically calculated for you. Enter the total employee wages for State Disability Insurance (SDI) withholdings and the SDI tax you withheld. Enter the Personal Income Tax you withheld. The totals will calculate for you based on the information you entered and payments previously made for the quarter. Verify the information, then select Next. Complete the declaration, then select Submit. Select Ok to confirm you want to submit your request. This is your confirmation that your tax return was submitted. Make note of your confirmation number or print a copy for your records, then select OK. You will see that your tax return status...

PDF editing your way

Complete or edit your what is a de9c form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export de9c directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your de form edd as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your how to report wages by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare De9c

About De9c

DE9C stands for the Quarterly Contribution Return and Report of Wages (QCRW) for Employers subject to UI, ETT, and SDI. It is a form that California employers must file every quarter, along with payment of unemployment insurance (UI), employment training tax (ETT), and state disability insurance (SDI) taxes. This form is required for all California employers subject to UI, ETT, and SDI taxes, regardless of whether they have any employees during the quarter. Failure to file DE9C and/or pay these taxes on time can result in penalties and interest. Therefore, any employer subject to these taxes in California needs to file DE9C every quarter.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do De9c, steer clear of blunders along with furnish it in a timely manner:

How to complete any De9c online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our Assistance team.

- Place an electronic digital unique in your De9c by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your De9c from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

What people say about us

E-file 24/7 from the comfort of any place

Video instructions and help with filling out and completing De9c